TopperBudget - Inciting Financial Literacy

Tackling Inequality In The Education System

Lead UX/UI Designer, UX for Social Good Collaborative Study, St. Edward's University, 2022

UX for Social Good is a course centered around tackling real-life problems stemming from the COVID-19 pandemic and finding remedies centered around empathy and practicality. During this semester-long study, my team and I took a deep dive into the education system and analyzed the critical problems impacting students today. Due to the pandemic, educational spaces have changed drastically over the past three years. Our team identified three key elements of inequality in the education space: standardized testing, the battle between public and private institutions, and inconsistent financial literacy.

Our team decided to focus on the issue of financial literacy due to our own first and secondhand experiences with debt attributed to financing college. These experiences provided us with a strong desire to empower students to tackle their finances head-on. Early in the semester, we conducted an anonymous survey to develop a better understanding of our peers' financial situation while attending St. Edward’s University. According to this survey, we found that more than half of the participants will have to pay off loans after they graduate.

Our research led to the realization that our generation fears the possibility of living with lifelong debt which could ultimately have a devastating effect on one’s quality of life, imposing harsh strains on relationships and leading to poor mental health. This fear prevents students and individuals in our society from reaching their highest potential. We want to help give students the power to lead a successful life after they graduate from college.

Our vision became to help St. Edward’s students especially—incoming freshmen—develop a better understanding of financial tasks. We wanted to give students the opportunity to develop sensible spending and budgeting habits during their undergrad.

We hoped that the opportunity for students to grow their financial literacy skills would prevent them from increasing their debt while in college. This could be through their denial to take out additional loans from outside the university or making a conscious effort to limit the number of credit cards they open. This might then allow students to live a life after college that is not shrouded by financial anxieties. Graduates should be able to develop a plan and be confident that they can pay off their student loans within a reasonable amount of time. Keeping all of these things in mind, my team and I developed a working prototype for TopperBudget.

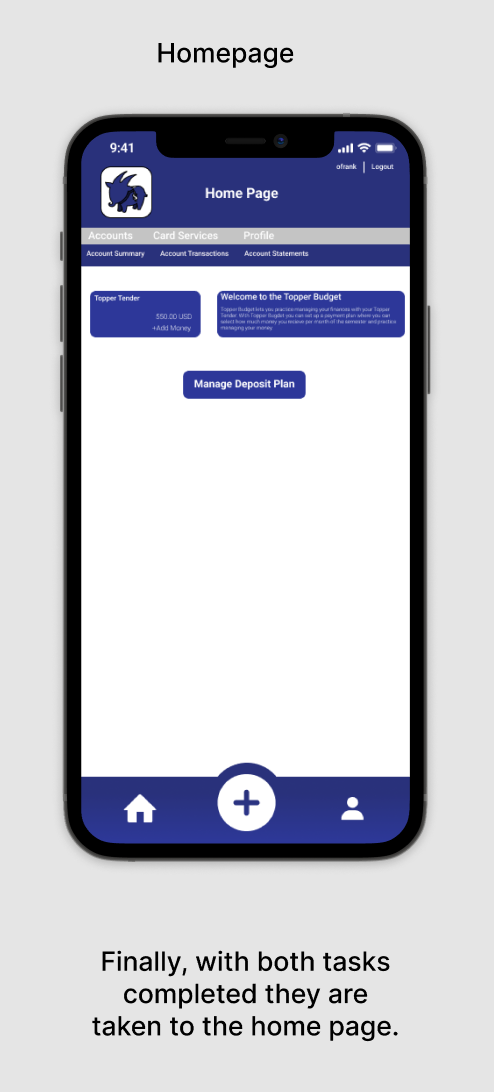

TopperBudget is a financial application built into the University’s Myhilltop system that offers students a hands-on experience to grow their financial literacy skills.

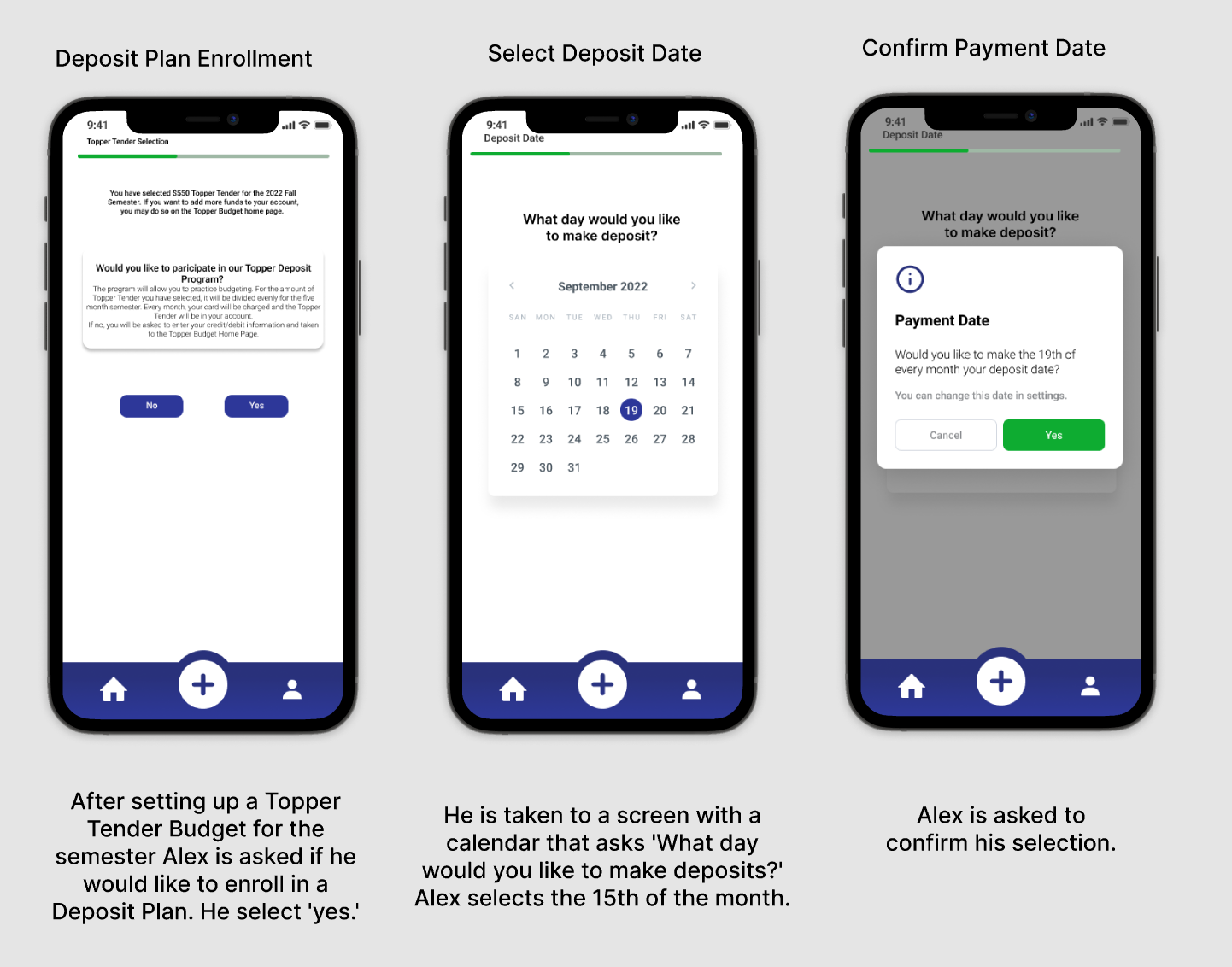

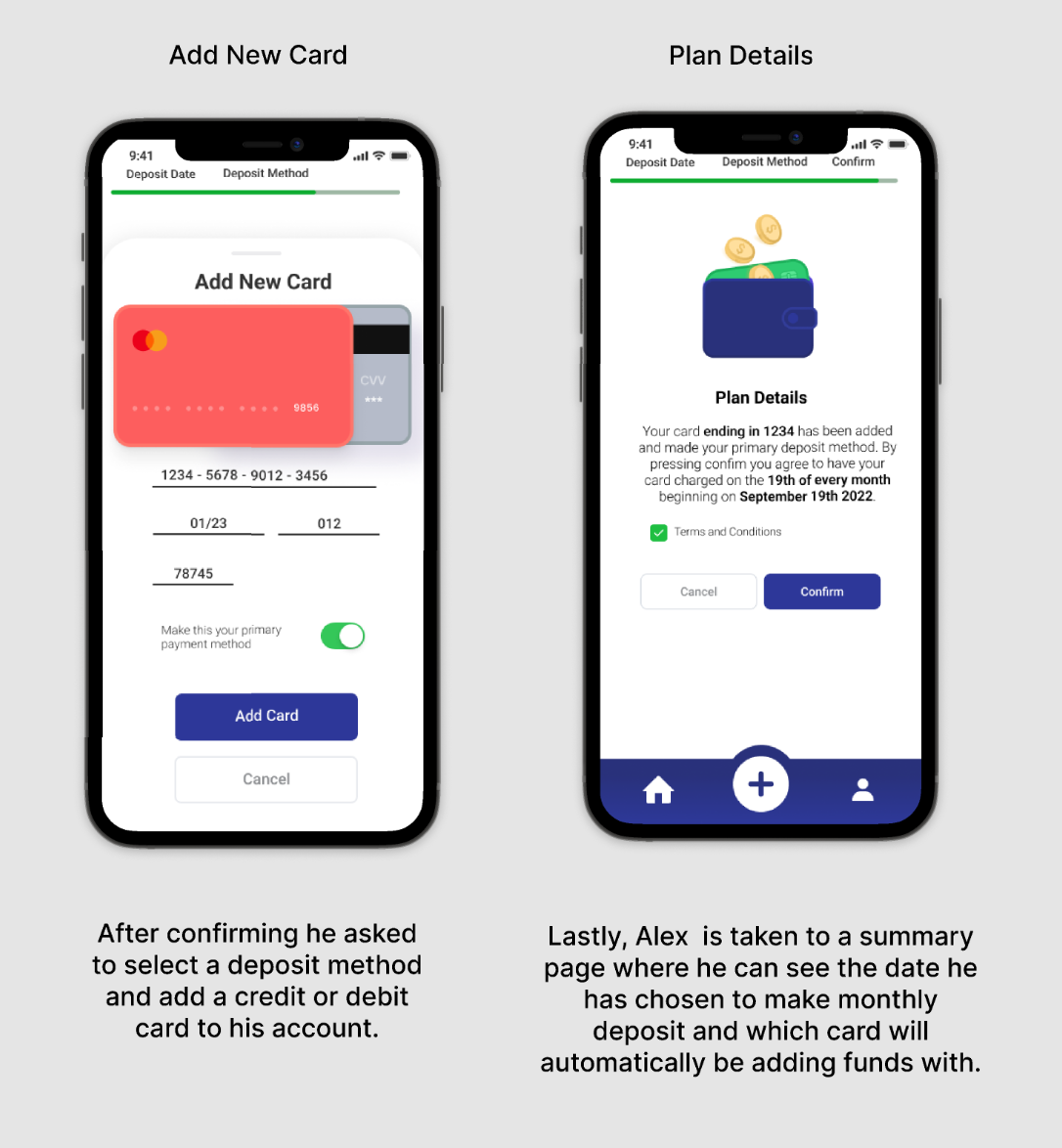

In the app, students can set a self-directed allowance for the semester, opt into a monthly payment plan, and add a primary payment method. Setting an allowance will enable students to have full autonomy over the amount of money they would like to have access to during the semester. These funds will then be used to help them learn what it means to have financial responsibility through a monthly deposit plan. To make these transfers as easy as possible students can also add cards to their accounts and designate a card to be used for deposits.

Deposit Plan Enrollment

Add/Link Payment Method

TopperBudget Homepage

Providing students with a hands-on opportunity to practice budgeting through this app would change the higher education experience and create a world where students no longer fear their financial future.